the rf front end market will have 8% cagr between 2018 and 2025, says yole developpenent. from $15 billion in 2018, the market should reach $25.8 billion by 2025.

samsung, apple, sony, lg, google and zte all use complex rf modules from broadcom, skyworks, qorvo, qualcomm, and murata.

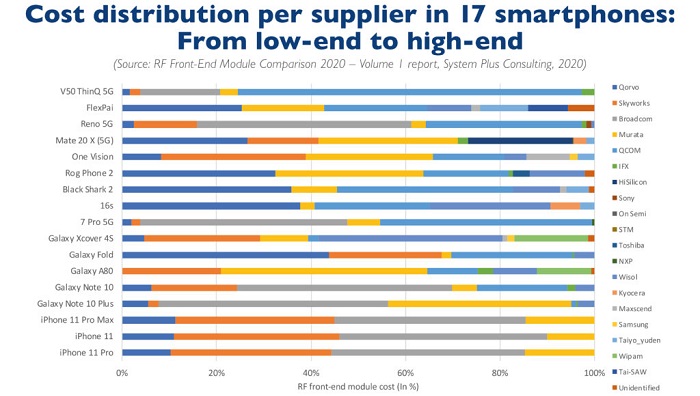

in the 17 selected smartphones, most of the components, measured by quantity, are supplied by qorvo murata and qualcomm.

“the rf front-end leaders share 81% of the market, with murata leading ahead of skyworks and broadcom”, says yole’s cédric malaquin, “qualcomm, which is already strong in lna, is catching up along with qorvo, thanks to the aggregation of tdk epcos’ filter business. established companies like infineon technologies, sony, taiyo yuden, nxp, and wisol also possess a market slice.”

some oems have manufacturing capabilities for supplying lna, switches, tuners, and filters which gives them an alternative to the rf front-end market leaders.

fabless companies are emerging, especially in china. unisoc rda, airoha, richwave, smarter micro, huntersun, and maxscend are examples of players scoring more and more design wins amongst the chinese oem brands.

foundries and design houses support this business model for compound semiconductor, silicon, and even acoustic wave filter.

from: